Investment Basics For Complete Beginners In Singapore Explained In Simple Terms

After over 10 years of formal education, sometimes even in top schools, many Singaporeans might still find themselves clueless about their personal finances.

That includes budgeting, banking, insurance, retirement planning and investments. The former four are pretty straightforward, but investments can be a real bore and chore for the less financially literate.

Investing can help build your wealth and is commonly considered a wiser alternative to keeping money stagnating in a savings account with low interest rates.

If you're a newbie to investments, keep reading to check out our simple guide & brief summary to help you start investing in Singapore!

How Much Money To Invest

You should be ready to invest once you satisfy this checklist:

- Have zero debt

- Have at least six months to a year of savings

- Ready to set aside the investment money for the next 5 to 10 years

- Done your research

As for the amount of money to invest, most financial advisors will suggest 10% to 15% of your income. Imagine losing an amount of money; if you'd go 'that sucks, but life goes on' and you'll still have enough funds to tide through emergencies like retrenchment, that is the amount of money you can afford to invest.

Types Of Investments In Singapore

#1 Shares, Stocks & Equities

Photo from Lorenzo Cafaro from Pixabay

Photo from Lorenzo Cafaro from Pixabay

This the most challenging and high risk option and is more suitable for the pros so we won't go into too much detail.

When you buy shares of a listed company, you co-own a part of it. If a company grows or is expected to grow, the share price increases and you can sell them and make a profit. Likewise, when a company goes bankrupt, you could lose everything. If a company makes money, they may give payouts as dividends yearly. You'll need a CDP and trading account, which will be explained later, to buy and sell shares.

#2 Bonds

Bonds are considered a good stepping stone for beginners as it's an easy, safe and low risk investment option. Basically, you're lending money to the government or corporations when you buy bonds from them. At the end of the tenure, you'll be returned the capital with interest.

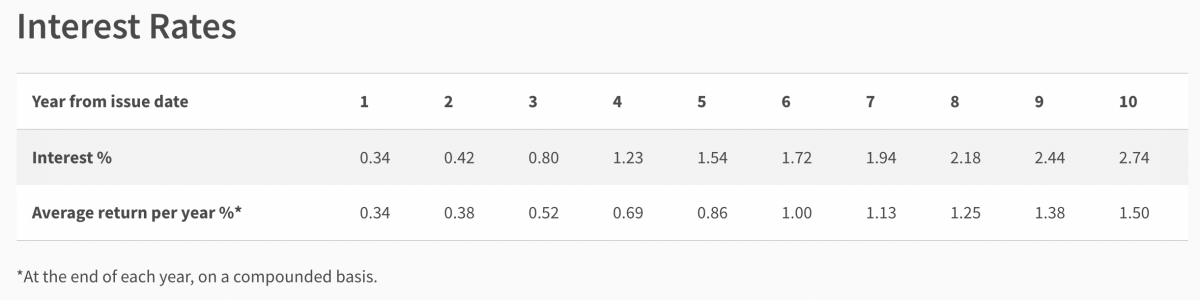

There are two type of bonds you can buy. The more common one is government bonds like Singapore Savings Bonds. It pays interest every six months for a period of 10 years with increasing interest over time. The longer you "lend" your money, the higher your returns. But the great thing about this is that you can exit your investment and redeem the interest any time with no penalties. You just need a bank account with a local bank (DBS, UOB or OCBC) or CDP and apply with your bank online or through an ATM. On the downside, returns are generally low. Below are the interest rates for bonds issued on 2 August 2021.

Photo from MAS

Photo from MAS

There are also corporate bonds which work the same way as government bonds except you're lending the money to a corporation and they're less commonly offered. These are typically riskier than government bonds as there's a chance the company might go bankrupt, in which case you won't get back any capital. Then again, high risk companies usually have accompanying high interest rates. You can buy these bonds through your trading account or through an ATM.

#3 Unit Trust

Photo from Presslogic

Photo from Presslogic

A unit trust is a fund where a group of investors pool their money together. This money is managed by a fund manager who channels it to a variety of investments in stocks and/or bonds. Successful investments are added to the fund and their returns are distributed to investors.

If you don't have time or energy to monitor stock markets, unit trusts are convenient as you can simply leave it to the professionals. Another advantage is that your money can be invested in a wide range of assets with as little as $100 a month or a lump sum of $1000. There's a lower risk as your assets are diversified; if one fails, the others can make up for the loss.

In exchange, your fund manager takes a sales charge which may be up to 5% of the fund. There may be other fees like an annual fee, initial service charge and redemption fee.

Unit trusts generally offer higher returns than bonds but are also more risky and suitable for those who are ready to invest for a long period. There are many factors to consider when choosing a unit trust and fund manager. The easiest way to go about it is through a bank financial advisor at DBS, UOB or OCBC.

#4 Real Estate Investment Trust (REIT)

Photo from Jason Goh from Pixabay

Photo from Jason Goh from Pixabay

REITs work similarly to unit trusts where your money is pooled with other investors and used to invest in properties like shopping malls, industrial buildings and hotels. The rental income collected by REIT is distributed back to investors as dividends.

Returns are high at around 4% to 8%, which could serve as a passive income. These high yields are because REITs are required to distribute at least 90% of their taxable income every year.

Disadvantages of REITs are that they can be risky as the market is volatile and dividends can fluctuate. For example, shopping malls took a big hit around March 2020 due to the lockdown, and REITs underperformed as a result.

You can buy and sell REITs through CDP like you would with shares.

#5 Exchange Traded Funds (ETF)

ETFs are similar to unit trusts except that the selection of individual stocks is determined by market indices like STI (explained later) and is passively managed by a fund manager.

The fees and charges tend to be lower than that of unit trusts. It can be easily bought and sold like stocks.

#6 FinTech

Photo from Presslogic

Photo from Presslogic

A portmanteau of "finance" and "technology", FinTech also works like unit trusts but is managed by automated technology. Instead of a person, investments are handled by a robo advisor - a digital platform that automates buying and selling according to their algorithm with little to no human involvement.

This is another noob-friendly option as it's hands-free, requires a low minimum balance and is typically much less costly than unit trusts. You can also set your risk tolerance to low and the robo advisor will recommend a portfolio with more low risk investment options. On the other hand, this is a relatively new technology and some might be skeptical about letting a robot make the decisions.

You don't need a CDP or trading account for this, just sign up with the robo advisor of your choice, transfer your money and start investing. Some popular robo advisors are Syfe and Stashaway.

Two Accounts You Need To Invest In Singapore - CDP Account & Trading Account

Your CDP (Central Depository) account is operated by SGX (Singapore Exchange) and acts like a safe for your securities like stocks and bonds that are listed in the Singapore Stock Exchange. As long as you're at least 18 years old and have a Singapore bank account, you can create your CDP account online.

Your trading account, opened with any brokerage of your choice, will give you access to the stock market and other investments to buy and sell shares. Most brokers will allow you to open an account for free although there will be a minimum commission fee of about $25.

There are over 10 brokerages to choose from. Tiger Brokers and moomoo are popular choices for beginners as they have relatively low commission fees. Interactive Brokers, TD Ameritrade and POEMS are handy for those who want to invest globally.

If you want to invest with your CPF money, you will need a CPIS account - a CPF Investment Account. This is only eligible for those who have at least $20,000 in their CPF Ordinary Account and $40,000 in their CPF Special Account. You can open this account with major banks in Singapore - DBS, UOB and OCBC.

Market Indices - to Calculate Market Performance

Photo from SGX

Photo from SGX

A market index is an indicator of the market. For example, the Straits Times Index (STI) is an indicator of how the Singapore stock market is performing. It tracks the performance of the top 30 companies listed on SGX like CapitaLand, Singtel, etc. You can follow different market indices to gauge how the market is faring.

These are some popular market indices in overseas regions:

- USA – Dow Jones Industrial Index, Nasdaq Composite Index

- China – Shanghai SE Composite index

- Hongkong – Hang Seng Index

- Japan – Nikkei 225 Index

And that's it. That's all the basic info you need to start your investment journey. You'll get the hang of it in no time!

Here are some articles on money saving tips so you can use that money for investments instead:

Share this article with your friends!

Text by: GirlStyle SG