How To Budget Your Expenses This Circuit Breaker Period

Impulse shopping due to boredom or the frustration of being cooped up at home this circuit breaker period is a real thing! ?

If you're living from paycheque to paycheque, have a spendthrift habit or are in debt, planning a budget and sticking to it is a must-do. Even if that's not the case, a budget can help you to save up for a BTO, car, wedding or holiday. ?

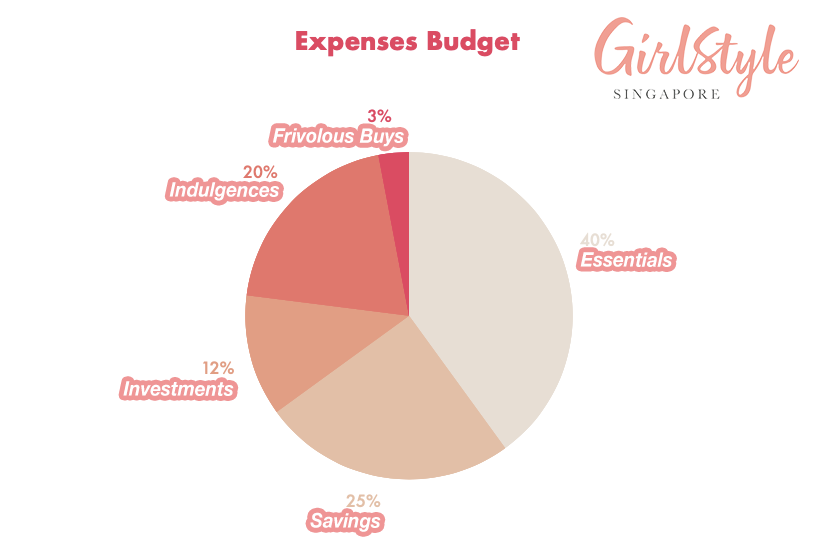

Before you unleash your credit card in an online shopping spree, have a look through our simple breakdown of how you could budget your expenses for your long term financial well-being.

Keep reading to find out more!

30-50% on essentials

Photo from Pinterest

Photo from Pinterest

Essential spending includes everything from electricity and water bills to meals and groceries. The range is quite large as it depends on your situation! If your parents are covering most of the hefty bills such as for the house and car, you can afford to spend less. If you're contributing more, then you'll need to allocate a bigger percentage of your income for essentials.

If you find yourself going way over the set budget, that means you might be splurging too much on certain items and could find cheaper alternatives.

20-30% savings

Photo from Pinterest

Photo from Pinterest

This includes savings plans, retirement accounts and funds for emergency situations.

Retirement can seem distant when you're in your twenties or thirties, but there's no harm in establishing money-saving habits early and also earning the compounding interest over time. Check out the best savings accounts in Singapore in 2020!

10-15% investments

Photo from Pinterest

Photo from Pinterest

Before you start investing, you should first find out if you're ready to invest! If you've ticked off all the boxes, you can set aside 10% to 15% of your income for investments. ?

10-30% on indulgences

Photo from Pinterest

Photo from Pinterest

This is any splurge that enhances your lifestyle like going to restaurants and bars, getting a new coffee maker and gym memberships. ✨

These aren't considered essentials but could make everyday life more enjoyable so a sizeable chunk of your income could go into this if you don't have any pressing future bills to pay.

0-5% on frivolous buys

Photo from Pinterest

Photo from Pinterest

In this category are things that make little to no difference in your life but still gives you a feeling of satisfaction to buy and own. This includes shoes, bags, clothes and decorative items, especially if you already have plenty of them in similar designs! ?

Photo from Girlstyle Singapore

Photo from Girlstyle Singapore

That being said, everyone's situation is different so take this as a rough guide and form your own budget breakdown that works best for your circumstances and financial goals! While you're here, check out some free money-saving apps.

Share this article with your friends who are always complaining that they're broke! ❤️

Text by: GirlStyle SG