Are You Ready To Invest?

Are you ready to invest? Investing gives your money the potential to grow faster than it could in a savings account. But at the same time, you are also putting risk on your money. The hope is the risk pays off with a healthy return, but sometimes you lose money. Remember, higher potential return always comes with higher risk.

It is always better to begin investing sooner rather than later.

Before you do invest, it's crucial to assess your finances and make sure that you have the necessary safeguards in place. Here is a simple 5-point checklist to see if now is the time for you to start investing.

Keep reading to find out more!

#1 Are You Financially Fit?

Photo from Pinterest

Photo from Pinterest

Pay off any debt.

You should check where you are from a financial standpoint. Make sure your debts are under control. The cost of your debt is likely to outweigh the returns you receive from investments. It does not make sense to invest money if you have a significant amount of debt and no emergency fund. Focus on reducing debt to levels that are comfortable to manage or, ideally, pay off all debt before investing.

#2 Make Sure You’ve Got Savings

Photo from Pinterest

Photo from Pinterest

Do you have enough saved to cover at least three to six months of normal expenses?

Before risking your money, you need some core savings, an emergency fund to cover unforeseen events. The generally accepted rule is to have at least three to six months of savings before you invest.If your career field is unstable or you are self-employed, you should go with six months to a year of savings.

#3 Why Do You Want To Invest?

Photo from Pinterest

Photo from Pinterest

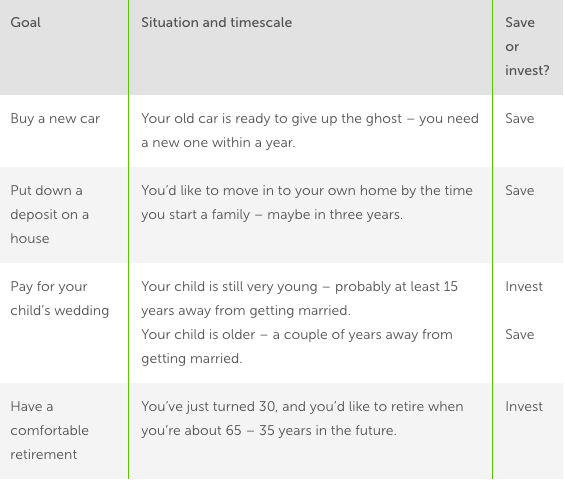

Before you get started with investing, you should have a clear idea of what your goals are.

Your financial goals should determine whether you invest or keep your money in cash savings. In general, you should be prepared to part with your money for at least five years, to give your investments a better chance of riding out dips in the market.

Here some typical examples of financial goals and investment considerations - save or invest?

Photo from The Money Advice Service

Photo from The Money Advice Service

If you are planning on using it for a down payment on a house or to pay for college, your investment choices will be different than if you plan on using it for retirement.

If you are planning on using it in the next five years, you will be better off by choosing a more conservative account for your money, as opposed to if your financial goals are more long-term, in which case you can choose investing in riskier investments.

Having well-defined goals can help guide your decisions, both before and after you start investing. Be detailed and realistic about what you want to accomplish.

#4 Do You Understand Your Investment Options?

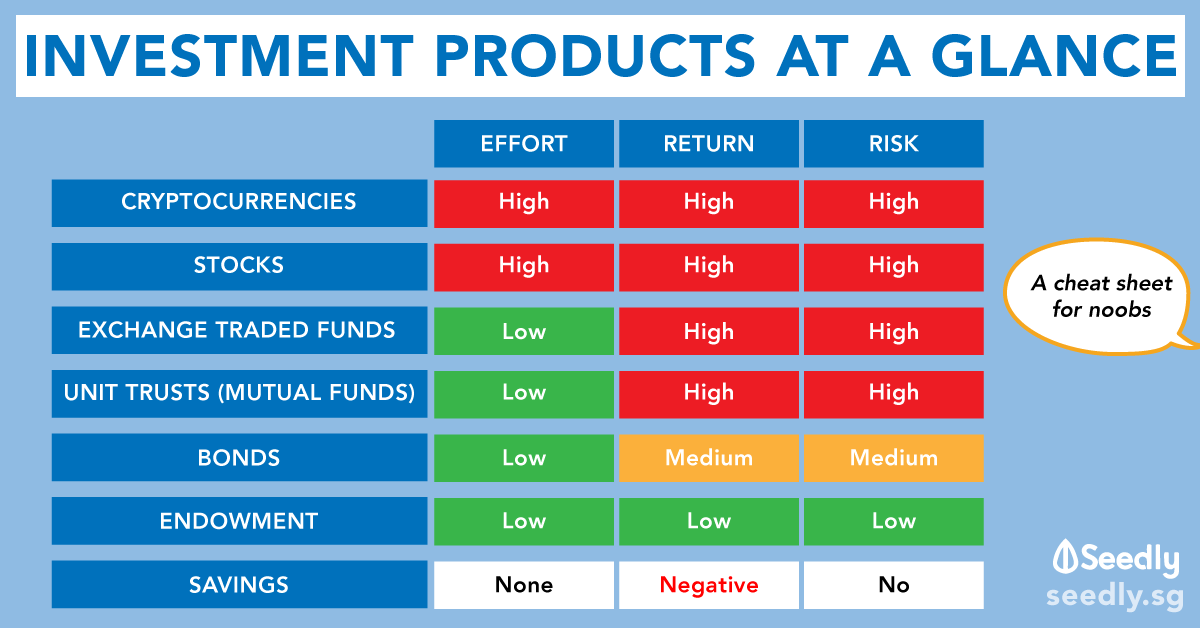

Do you have a basic understanding of the investment options?

Navigating the stock market shouldn’t be learned through trial and error. You should take the time to educate yourself about the stock market and how it works before you start investing. You must be willing to invest time to read and understand each instrument on how much risk it carries.

Photo from Seedly

Photo from Seedly

To kickstart, here are some of the most popular investments for beginners:

Stocks

- A stock is a share of ownership in a single company. Stocks are also known as equities.

Bonds

- A bond is essentially a loan to a company or government entity, which agrees to pay you back in a certain number of years. In the meantime, you get interest.

- Bonds generally are less risky than stocks because you know exactly when you’ll be paid back and how much you’ll earn. But bonds earn lower long-term returns, so they should make up only a small part of a long-term investment portfolio.

Mutual Funds

- A mutual fund is a mix of investments packaged together. Mutual funds allow investors to skip the work of picking individual stocks and bonds, and instead purchase a diverse collection in one transaction. The inherent diversification of mutual funds makes them generally less risky than individual stocks.

Exchange-traded Funds

- Like a mutual fund, an ETF holds many individual investments bundled together. The difference is that ETFs trade throughout the day like a stock, and are purchased for a share price. An ETF’s share price is often lower than the minimum investment requirement of a mutual fund, which makes ETFs a good option for new investors or small budgets.

Want more details on the investment options out in the market? Click on this cheat sheet to find out more!

#5 Know Your Risk Profile

Photo from Pinterest

Photo from Pinterest

All investments contain an element of risk. These include the risks from:

- General market conditions

- Fluctuations in currency exchange rates and interest rates

- Possibility of companies defaulting or going bust

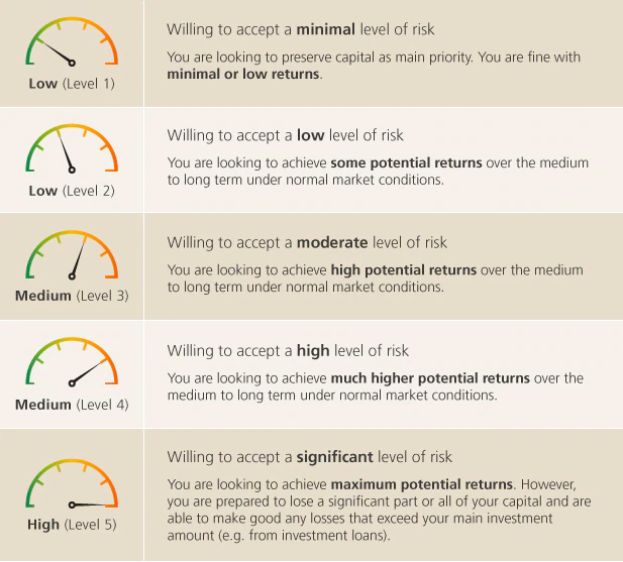

Your risk profile is dependent on two main components, your risk appetite as well as your time horizon. The key to successful investing is in understanding and managing these risks appropriately. Also, if your investment suffers a loss, will it impact your other commitments, such as loan repayments? Do not take the risk if you do not have the time to recover from your losses. Be extra prudent when investing your retirement savings.

Photo from DBS

Photo from DBS

Your risk appetite is more about how much you can afford to lose rather than how much you want to make.

Try this risk tolerance questionnaire from the CPF board to determine your risk profile.

#Tip

Before you begin investing, it is a good idea to consider if you would benefit from professional advice from a regulated independent financial adviser. There are plenty of financial professionals out there that can help you, including personal finance experts and expert advisers. Although some of these people cost money to work with, most will offer you a consultation for free, which might help to steer you towards a better action plan for your long-term financial goals. But you shouldn't blindly trust your financial advisor. Be sure you clearly understand the risks associated with each investment before you commit to it.

There’s never a perfect time to start investing. Ultimately, it’s up to you to decide whether if you should start investing to reach your financial goals.

If you felt that you are financially not ready, save and invest when you are ready! Read our post on "Best Savings Accounts in Singapore 2020" to get the best interest rate to multiply your savings.

Share this post with your friends who are thinking of investing!???

Text by: GirlStyle SG