You Are Not Alone: 5 Money Lessons I Wish I’d Learned Sooner

Have you ever had one of those moments where you look back at something you've done and can't help but wish that you could time travel and change the past? That's how I feel when I think back about some of the financial decisions I had made when I was in my 20s.

I could still remember the days when my parents will nag at me to study hard so that I can get a good job, save more money and stop buying clothes. (Yes, I admit I'm a shopaholic, still am ?but only spending within my means.) But other then that, we didn't talk much about money or learn in school about personal finance while growing up.

I’m turning 31 this year, and I feel like I have gained appropriate financial knowledge through the past decades to share several invaluable money lessons that I wish I’d understood long before now. Here are five money lessons that are crucial, good to know and embrace when you are younger.

Back To The Basic

Photo from Presslogic

Photo from Presslogic

Being young is probably the favourite excuse people use to procrastinate. (I'm guilty of this.) If you are using this as an excuse, you need to understand that you are missing out on taking advantage of the very best years in your life to save for retirement. Alright, I know what you must be thinking, retirement might seems far-fetched for you now but you will understand why at the end of this article.

During my 20s, I have the same mindset and spend whatever I've earned. YOLO! It is true that you only live once. You want to enjoy life to the fullest and hop on to any opportunity to experience new activities, buy items that were on your wishlist the longest time and go holidays with your friends etc. And the list can go on and on.

Where did the money go? Did I spend too much on shopping? Or eating out too much? I have no idea about my expenses at all! I knew it was time to change my bad money habits. But how?

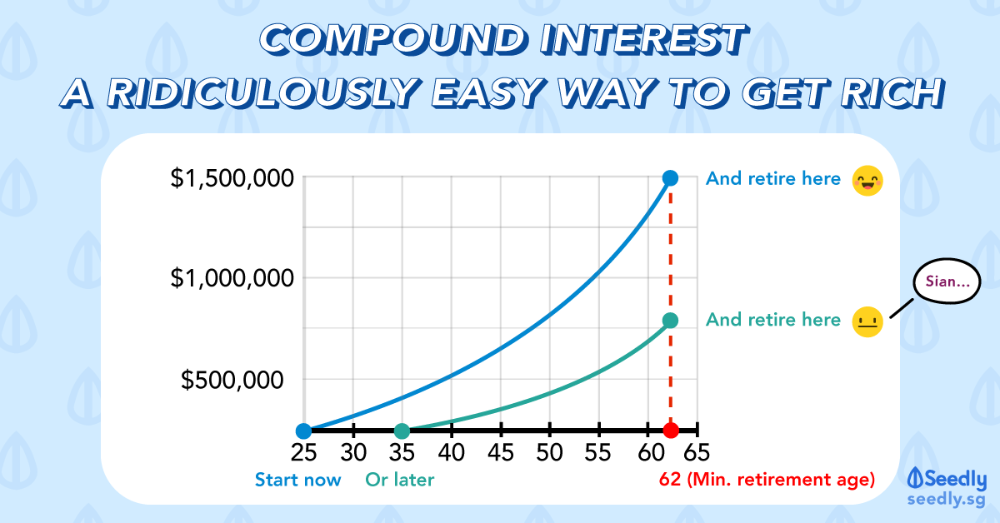

#1 Google About Compound Interest

Photo from Seedly

Photo from Seedly

The real secret to compound interest is less about the amount that is saved, and more about the amount of time it is invested. The earlier you start saving, the more years you’ll give your money to multiply and grow. Trust me on this. If I could turn back time, I will definitely start saving when I was younger, even as little as S$1 a day, will be better than not saving at all.

Key Takeaway:

? Start saving! You can start small with these money-saving challenges.

?Optimise savings accounts for the best interest rate. Compound interest, the easiest way to let your money grow by itself and put your money to work for you! The key is to start early and be consistent.

*P.S. I'm not trying to be naggy, but I need to emphasise the importance of saving. There is a Chinese phrase - "年轻是本钱", meaning Youth means/is wealth. So take advantage of it while you can.

How to turn your hard save money to ongoing cash flow?? Click here to get advice from an expert.

#2 Set A Budget, Period

Photo from Presslogic

Photo from Presslogic

Creating a budget is the first step to controlling your spending and start saving. With a budget in place, it helps you to stay on track on a day-to-day basis and gain more control over your finances.

You will be surprised by the amount you spend. Because I did, after just one month of tracking, I reviewed my spending and to my horror, not only I spent everything I made, I even eat into my savings! That was the reason why my savings never grow. It was lesser! So, how to track?

Record your expenses. Every day. Yes, I mean it.

If you don't keep up with what you're spending, you will not be able to set a budget to control your spending. To track your expenses you can either start with a budget spreadsheet template and customise it or use money apps as it is more accessible on-the-go.

Key Takeaway:

?Create a budget and track your expenses!

?Review your spending regularly! As this allows you to look at the overall picture of your spending habits to see if there is an area where you can reduce your spending, or even eliminate it.

How to set a budget when every spending seems essential? Learn from someone who has gone through your dilemma here.

Unexpected Event In My Life

Photo from Presslogic

Photo from Presslogic

At the age of 23, an unexpected medical condition caught me off guard. I was diagnosed with an ovarian cyst and required to undergo surgery to have it removed. I had no idea about ovarian cyst as it was not on my radar. Due to the regular visits to my GP, she advised that I should visit the gynaecologist for a checkup. After that everything happened quickly. It was a rollercoaster of scans, specialist appointments and finally the surgery.

Photo from Presslogic

Photo from Presslogic

The whole process was tedious and stressful as I need to take time off from work for the medical appointments and the cost for the consultations and scans are not affordable. Bills piled up, soon enough I find myself stressing over credit cards bills. Due to my bad money habits, my savings was not enough. Neither do I have emergency funds set aside for these unexpected medical expenses.

#3 Build an Emergency Fund ASAP

Photo from Presslogic

Photo from Presslogic

If I had known earlier, I could have relied on emergency funds instead of having to use credit cards which lead to a snowball of bills.

Some of the top emergencies:

? Job Loss (unexpected loss of income)

? Medical Expenses (Health checkup, dental)

? Unpredictable Events

The best example of unpredictable events will be the current situation, Coronavirus (COVID-19) pandemic. As the fight against coronavirus won't be over at any time, it is hard to forecast how long the current phase of the pandemic will last. Business face financial challenges and some companies may force you into early retirement. If you lose your job, for instance, you could use the money to pay for necessities while you find a new one.

In a nutshell, you should have at least 3 to 6 months' worth of expenses. To determine this amount, add up how much you spend in a single month on things that you can’t go without (e.g. food), and the contributions you owe each month (e.g. monthly savings or a mortgage).

Too complex? Use this emergency fund calculator to figure out how much you should save.

Don't worry if you do not have that amount. Either do I but I have started to build mine. Start small, but start. Having even $500 saved can get you out of many financial scrapes. Put something away now, and build your fund over time.

Key Takeaway:

?Starting a small emergency fund of around $500 to $1,500 is the first step to building a fully stocked emergency fund. Just enough so you're not living paycheck to paycheck.

?Get rid of bad debt, credit cards, personal loans. Pay it off!

Can you afford to live without income for the next 3 months from now? If not, learn more to get yourself prepared.

#4 Insurance Is A Must!

Photo from Presslogic

Photo from Presslogic

Frankly, if this medical condition never happens, I would not take the initiative to find out more about insurance. I am generally skeptical about insurance policies. My parents are not financially savvy and not a believer in buying insurance. Thus, I have the same mindset and assumed that the processes are too complicated with all those legal agreements, having to understand and comparing the details of various insurance policies are too time-consuming!

Plus, I'm young, single and healthy, insurance is the furthest thing from my mind. Putting funds aside for insurance seems like a waste of money. At least that's what I thought. The importance of having insurance didn't hit home until I realised I needed it.

Thankfully I have my peers to guide and advise me on the basic insurance terms to help me to understand my options which made the process less complicated.

I took the initiative and consulted a few financial advisors to advise on the polices. To my surprise, it was not what I have expected. The advisors whom I have consulted with were very patient and detailed with their explanations. You need to play your part as well as it takes two hands to clap. It’s important to understand the details of your insurance policies to make sure you have the coverage you need, at a competitive price.

If you have additional questions regarding your insurance policy or wonder if you could be paying too much, just ask your advisor. Clarify and clear your doubts. They can help you find an insurance policy that is not only transparent and easy to understand, but also fits your budget.

There are various types of insurance products like life insurance plans, term insurance, health insurance, home insurance and more. The core of any insurance plan is to offer you protection. Only get policies that you need and don't go overboard as you want to avoid unwanted financial stress.

Key Takeaway:

? Research and compare the different policies available. Do not limit your options.

?Consult a financial advisor. A good financial advisor will be able to pin down your needs and explain in details on the policies you need and considering within your budget.

Bottom line: Life is unpredictable. Even if you are young and healthy, that does not mean you won't have a medical emergency tomorrow. It is best to plan early and have yourself covered. The best part, premiums are lower and more affordable when you start the plan early.

Would you rather spend the money for a luxury vacation in Europe or paying for hospital bill? Learn more on how to protect your hard-earned money for good.

#5 Realistic Financial Goal Setting

Photo from Presslogic

Photo from Presslogic

This is similar to work, where you use KPIs (key performance indicators) to measure and track if your goals / objectives have been met. Similarly, setting financial goals will help to achieve what you want the most in life. Goals allow you to track your progress and force you to prioritise near-term demands with long-term desires.

There are different types of financial goals, some can be reached within a year (like getting a laptop or for a vacation) while others might take longer to achieve, like saving up for BTO. (Which I am saving up for! ?)

Photo from Presslogic

Photo from Presslogic

Take some time out from your daily routine during this Circuit Breaker, and think about what would you like to with your money. The financial goals you would like to achieve in the future. Review from time to time, as it makes sense to take a fresh look at your financial position and goals as you might want to make a few changes along the way.

Key Takeaway:

Financial goals are specific, measurable, achievable, realistic and time-bound. They are the goals you want to achieve the most in life. Still not sure what to aim for? Here are some personal financial goal examples to help get you started.

?Start an Emergency Fund

?Pay off Debt

?Invest in Insurance

How much do you need to apply for BTO? Are you eligible based on your current situation? Let an analyst do the math for you here.

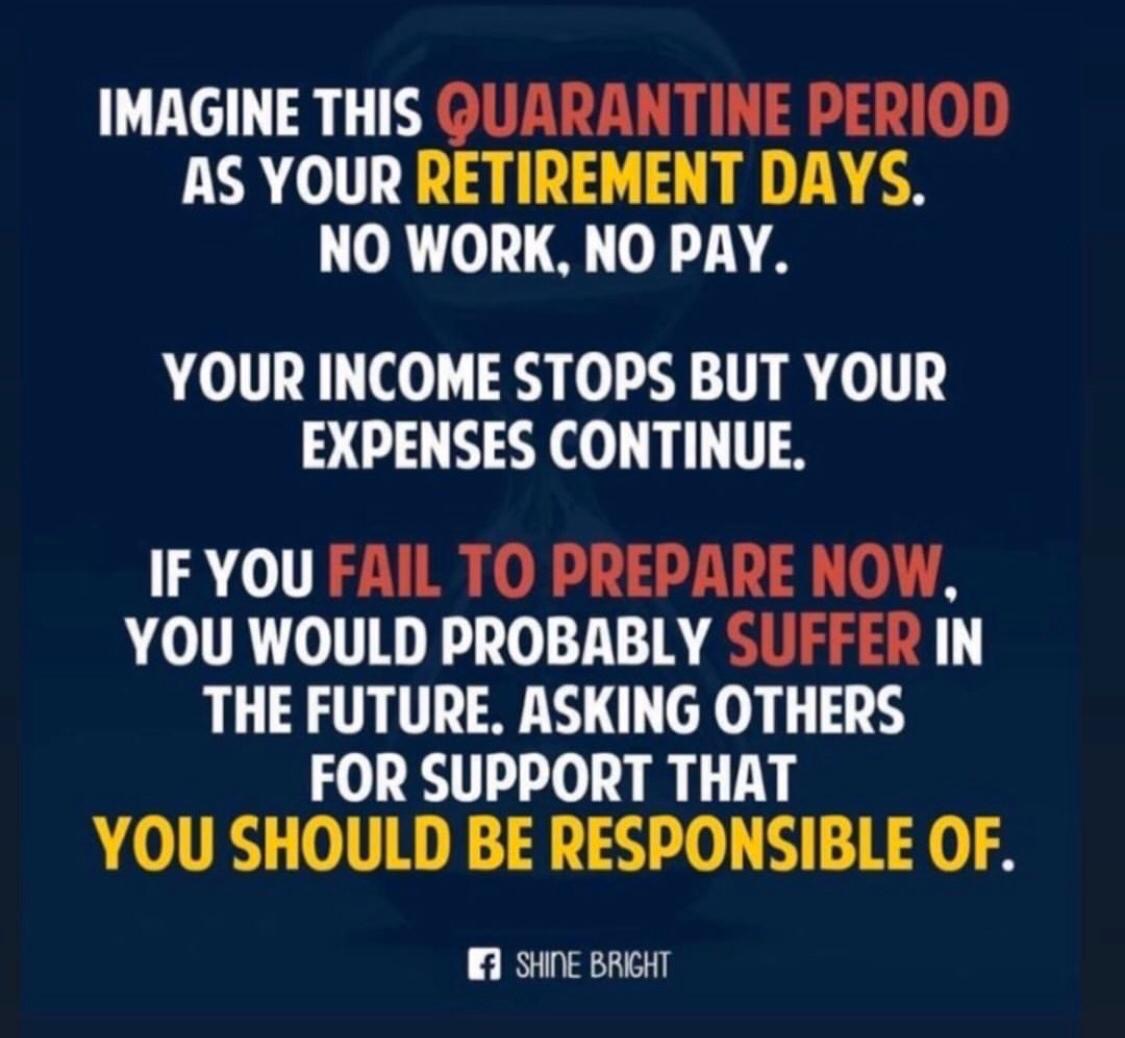

#Bonus Tip - Retirement

Photo from Pinterest

Photo from Pinterest

The earlier you start, you will earn more money over time.

??? Time is Money! ???

Interested to find out more? Need expert advice on policy plans and coverage to find out what you really need? Click here to fill up a simple form for us to learn about your experience and offer our assistance.

*All information shared will be kept confidential.

Share this article with your friends to equip them with this money knowledge!

Text by: GirlStyle SG