5 Financial Habits You Need To Form In Your Twenties

When you hit the magic 21-year-old, you need to have a strategy when it comes to planning your income versus your output. It is part of adulting smart. This way, you will have more disposable income for travelling and rainy days. A good plan will expedite your financial stability!

Here are five habits you need to start forming!

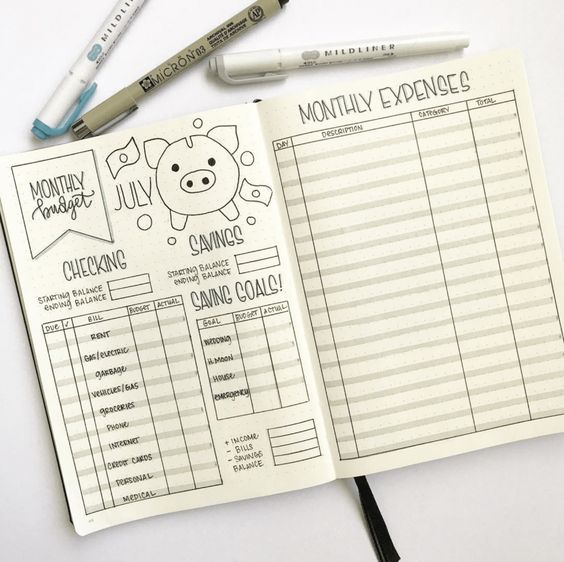

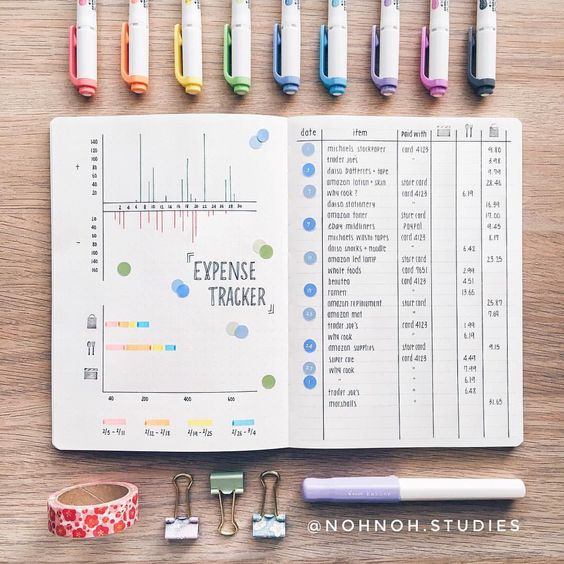

#1 Have A Plan That You Can Follow Through & Stick To IT

Create a plan that will eventually lead you to your #moneygoal in as little time as possible.

For a start, you can try this 50/30/20 budget method to plan how to use your money every month.

#2 Live Way Below Your Means

For example, you don't need a cup of expensive coffee or bubble tea every week! When you total up your expenses for small indulgence (such as coffee and bbt) per month, it can be a significant amount.

Make a conscious effort to live below your means and put the money into your savings instead.

#3 Take A Side Job (If You Are Studying)

It will be tiring, but having more pocket money means FREEDOM. You might also meet new people who could help you later on in your career.

#4 Plan Ahead For Big Expenses

Don't swipe your credit card conveniently without planning how to pay for it later. Instalment plans are not exactly the solution. It can potentially create bigger problems later on. Plan ahead and limit your purchases.

#5 Start Your Saving Plan Today. Repeat For The Next Month And The One After

Start putting money aside for saving purposes now and don't touch it regardless. Set goals and be motivated to watch it grow. This is one of the best ways to expedite financial stability.

When it comes to the right time for BTO and other significant expenses, you are READY. And that is a good feeling.

Make these 5 financial habits your own and stay through with the initial discomfort. You will be comforted again when you see your bank grow!

Photo Source: Pinterest

Text By: GirlStyle SG